Wealth Management

What does true wealth success mean to you?

For some, it’s the freedom to focus on family, purpose, and legacy. For others, it’s the confidence that come from knowing each financial decision supports their long-term goals, so that even significant life transitions can be navigated without financial stress

At Richard P. Slaughter Associates, we understand that affluence adds complexity, and that no two families with significant wealth define success the same way. That’s why we start by helping you articulate your own definition of financial success as part of a personalized wealth management strategy designed specifically for individuals and families with higher net worth — whether that strategy includes strategic business exits, generational wealth planning, or simply living without financial worry.

If your personal definition of financial success isn’t obvious right away, that’s what we’re here for. Through our True Wealth Management system, we’ll work with you to discover what matters most and deliver coordinated strategies. Because true wealth isn’t just about having more — it’s about having your wealth work intentionally for the life you want.

Let’s ConnectA proven approach to managing your wealth with purpose

Achieving financial success takes more than a well-crafted plan. It requires a trusted partner who can skillfully execute and evolve that plan as your life changes. At Richard P. Slaughter Associates, our fiduciary team brings deep expertise in wealth management, delivering a disciplined strategy across every facet of your financial life and always with your best interests at heart.

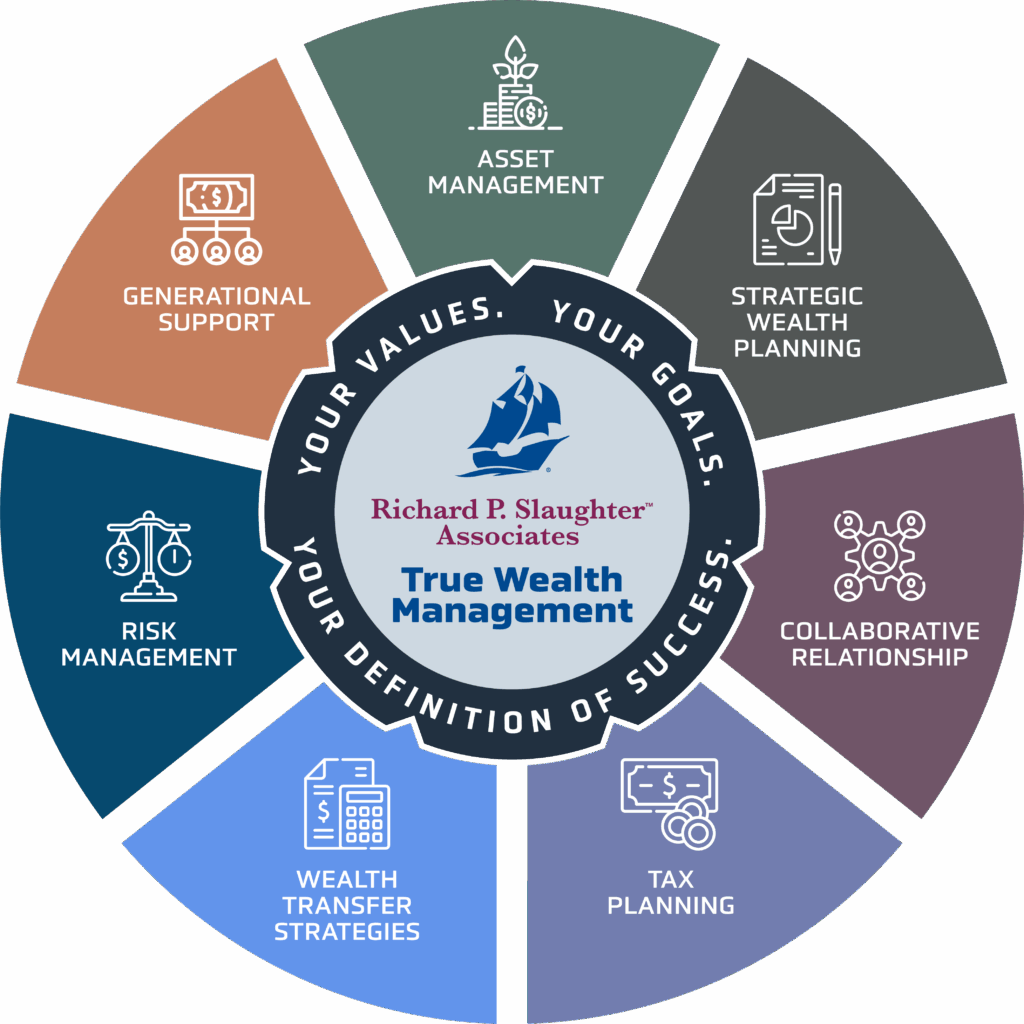

Through our proprietary True Wealth Management process, we provide planning, advising, and investment management across these key areas of your financial life:

How we deliver a superior wealth experience

Asset Management

True asset management means ensuring that every asset — from market investments to real estate, private equity, and business holdings — works in strategic alignment. Our coordinated approach gives you the confidence that your full balance sheet is managed to support your definition of financial success.

Strategic Wealth Planning

We translate complexity into clarity. Our planning process is built around your evolving goals, not just the market. With a deep personal relationship at the core, we build a strategic plan that adapts as your life, finances, and business evolve, so you always have confidence in your path to achieving all your wealth goals.

Collaborative Relationship

You’re at the center of everything we do. We coordinate seamlessly with your existing advisors — CPAs, attorneys, insurance professionals — to unify strategies across all dimensions of your financial life. We don’t just “work with” your team, we lead it on your behalf.

Tax Planning

Minimizing tax impact is one of the most effective ways to build and preserve wealth. We partner with your tax advisor (or bring our own) to uncover proactive strategies that optimize your tax position now and into the future.

Wealth Transfer Strategies and Generational Support

Legacy planning is about more than transferring assets. it’s about preparing your wealth and your family for what’s next. Our approach ensures your estate plan reflects your values, preserves intent, and creates long-term impact. We work closely with estate attorneys and other advisors to build structures that protect wealth, empower heirs, and support your philanthropic goals.

Risk Management

Protecting your wealth is just as important as growing it. We proactively identify the risks — market, legal, operational, or personal — that could compromise your goals. Then we build strategies to mitigate them. From insurance structuring to liquidity planning, we help ensure your financial plan is resilient, so you can move forward with clarity and confidence.

The path to true wealth success begins by defining your journey

Every successful wealth management experience starts by defining what success means to you.

At Richard P. Slaughter Associates, we combine deep expertise, trusted partnerships, and an expansive range of tools to build a fully personalized strategy — a strategy not only to help you grow and preserve wealth, but to align your financial resources with your life goals.

We call this our True Wealth Management Process: a comprehensive, four-part system that adapts to life transitions, changing markets, economic conditions, and tax laws while always keeping your personal objectives at the center.

This discovery phase is our chance to truly get to know you, your family, and your goals. We seek to understand your financial reality, values, and vision for the future. During this phase, we also connect with your existing team of professionals to begin forming the foundation of a highly coordinated wealth strategy.

- Explore your financial picture, lifestyle preferences, and long-term goals.

- Build a relationship grounded in trust, empathy, and clarity.

- Identify what’s most important to your financial and personal well-being.

Through strategic financial planning, we create multiple scenarios that enable you to make informed decisions about achieving your family goals, navigating life changes and transitions, and maximizing your wealth. Our goal is to give you confidence, clarity, and control over your financial future.

- Design a comprehensive strategy to accumulate, invest, and deploy resources.

- Identify and implement strategies to maximize your wealth, including asset returns, tax efficiency, cash flows, and risk mitigation.

With your personalized True Wealth plan in place, we move decisively into action, overseeing all aspects of your financial life with precision, care, and alignment to your most important goals. Execution isn’t just about investments. It’s about ensuring your entire wealth strategy is put into motion, coordinated effectively, and adapted as your needs evolve. Our team serves as the proactive hub, integrating services, experts, and decisions to keep your plan progressing with clarity and confidence.

Execution includes:

- Asset Management: Advise and actively manage assets to maximize return, produce needed income, and ensure appropriate risk; make tactical adjustments based on market, economic, and personal changes; monitor performance against clearly defined risk-based benchmarks.

- Planning Implementation: Put key strategies into action, such as tax mitigation, income generation, estate and wealth transfer structures, risk mitigation, and liquidity solutions.

- Coordinated Oversight: Act as a central coordinator for your financial team — tax professionals, attorneys, insurance specialists, and others — ensuring everyone is informed, aligned, and working towards your objectives.

- Life Event Navigation: Support you through transitions such as retirement, business sale, inheritance, divorce, or health changes, translating complexity into clear, timely decisions.

- Accountability & Follow-Through: Ensure to-dos are completed, paperwork is processed, accounts are properly structured, and nothing falls through the cracks. We don’t just plan — we execute and report back.

- Communication & Progress Reviews: Provide ongoing updates, check-ins, and review meetings to track progress, explain results, and make refinements as your goals or circumstances change.

The experience of working with Richard P. Slaughter Associates extends far beyond numbers and performance. You’ll receive ongoing support from a team of fiduciary professionals who provide thoughtful counsel and proactive service designed to anticipate your needs.

- Stay informed through regular updates and education on all elements impacting your wealth and personal goals.

- Receive coordinated support from all the professionals advising on your wealth.

- Access independent, expert advice for any financial decision you face.

Where are you in your financial journey?

Approaching a transition– such as retirement, business or major asset sale, marital changes? Even inheritance is a transition.

Planning your family’s future?

Do you wish to help support and protect future generations or your legacy?

Seeking a more personal and comprehensive experience?

Do you need a more personal and comprehensive relationship that addresses your entire financial life?

Is our wealth management approach the right fit for your goals?

Complete this brief survey telling us a bit about yourself and your goals, and we’ll create a personalized overview to explore how our expertise aligns with what matters most to you.

Go To SurveyAdvance your journey with expert fiduciary wealth management

Join our email list and receive a monthly newsletter with our insights on anything and everything influencing your wealth.

subscribe