For many business owners, the wealth accumulated in their businesses is more than just a financial achievement; it’s a reflection of years of dedication, and often, a deep sense of gratitude for the opportunities and support that fueled their success. As the time for transition approaches, a desire to “pay it forward” through meaningful charitable giving naturally arises. This article explores how strategically donating privately held company stock can serve as a powerful tool, offering significant benefits that extend far beyond simple philanthropic gestures, providing valuable insights for business owners considering their exit strategies.

The journey to wealth and the desire to give back are often intertwined. A notable correlation exists between those who engage in charitable giving and those who achieve high levels of financial success. This raises a fundamental question: “Do I give because I’m wealthy, or am I wealthy because I give?” Regardless of the answer, the intrinsic desire to make a positive impact is a common thread among successful business owners. The growth of Donor Advised Funds (DAFs) over the past decade, with billions in annual contributions, underscores this trend. DAFs provide charitably inclined business owners with advanced tax savings and flexible giving strategies, often without the complexities and costs associated with establishing a private foundation. By strategically utilizing privately held stock for charitable contributions, business owners can achieve alignment between their business success and philanthropic aspirations, accomplishing multiple objectives that resonate on both financial and personal levels.

Choosing the Right Donation Method: Beyond Cash and Public Securities

When considering charitable donations, the most straightforward approach is often a cash donation. However, many are also aware of the tax advantages of donating low-basis, publicly traded securities. By donating these securities, individuals can avoid capital gains taxes while preserving their cash reserves. This is possible because charitable entities, such as DAFs, are typically tax-exempt.

However, there’s a third, often overlooked, option: donating privately held business stock. While this asset is illiquid, it offers unique benefits not available with cash or publicly traded securities. And while it requires a few extra steps with the custodian of the DAF, the extra time spent can drastically improve your tax savings for the same donation amount.

The Tax Advantages of Donating Illiquid Stock

Donating privately held stock offers several advantages. First, it allows owners to retain their liquid assets for other purposes. Second, it provides an immediate tax deduction for the fair market value of the donated stock without having to pay capital gains tax first.

Consider this example:

A business owner who created 20,000 shares of stock at $1 per share ten years ago when they founded their business, is now considering selling the company for $20 million. The owner wishes to donate 10% of their proceeds to charity, which would be 2,000 shares valued at $2 million.

After consulting with their advisory team on gifting strategies, the owner considers two options:

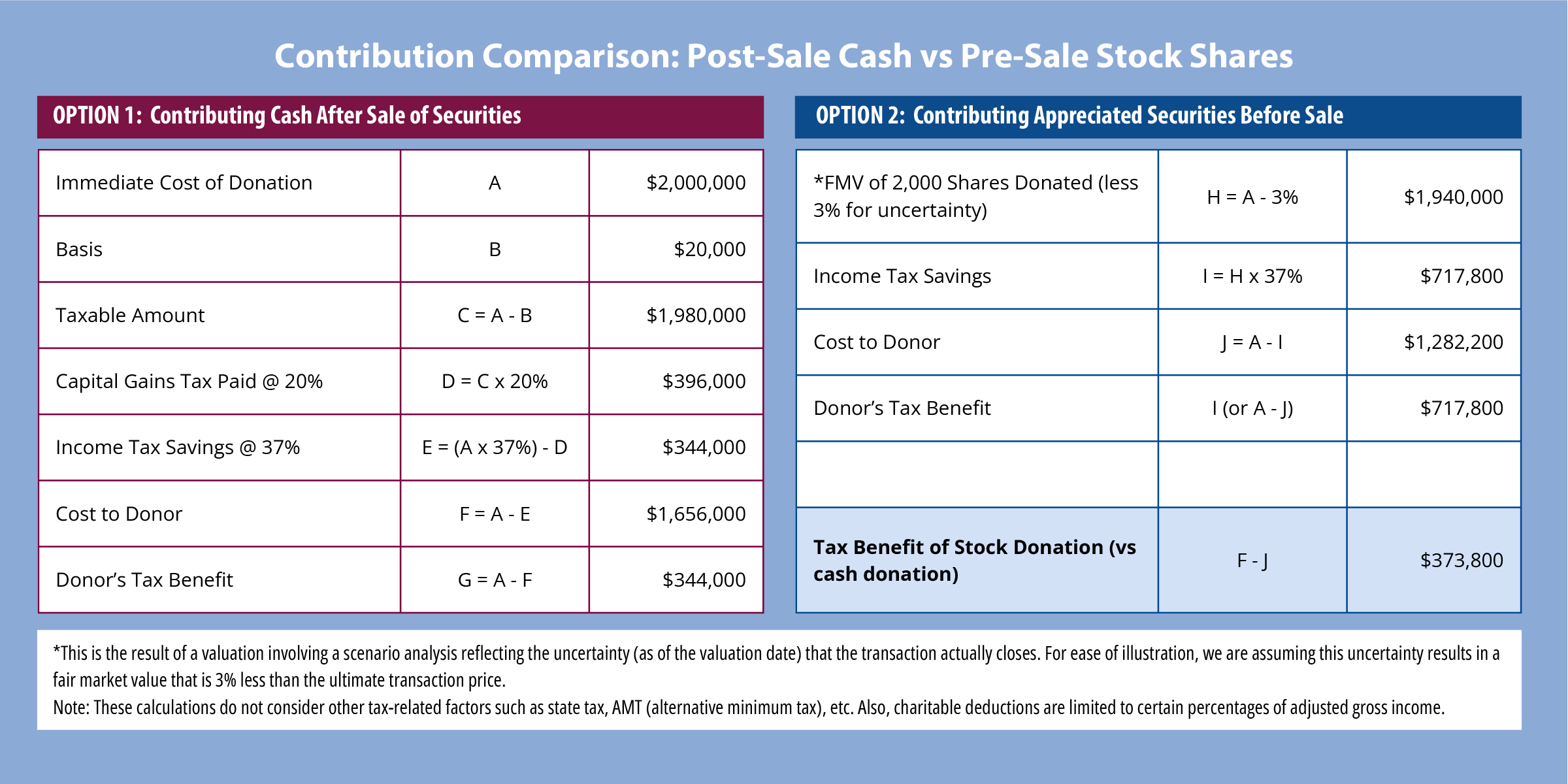

- Donating Cash After the Sale: Making a $2 million donation after receiving $20 million in proceeds. This results in a tax benefit of $344,000, assuming the highest personal income tax bracket.

- Donating Shares Before the Sale: Contributing 10% of the shares to charity before the sale, requiring an independent valuation. An appraiser determines a fair market value of $1.94 million, reflecting a moderate and common 3% discount for closing uncertainty. This results in a tax benefit of $717,800 — $373,800 more than donating cash after the sale.

Private Foundations vs. Donor Advised Funds: Choosing the Right Vehicle

While a DAF offers significant advantages for charitable giving, some business owners may consider establishing a private foundation. Both vehicles allow for the donation of privately held stock, but they differ significantly in terms of complexity and control.

A private foundation offers greater control over grantmaking and allows for the establishment of a family legacy. However, it comes with substantial administrative burdens, including:

- Increased Regulatory Oversight: Private foundations are subject to stricter IRS regulations and reporting requirements than DAFs.

- Higher Operating Costs: Establishing and maintaining a private foundation involves legal, accounting, and administrative expenses.

- Excise Taxes: Private foundations may be subject to excise taxes on investment income and certain distributions.

- Minimum Distribution Requirements: Private foundations are required to distribute a minimum percentage of their assets annually.

In contrast, a DAF offers:

- Simplicity and Ease of Use: DAFs are relatively easy to establish and administer, with fewer regulatory requirements.

- Lower Operating Costs: DAFs typically have lower operating costs than private foundations.

- Anonymity: DAFs can provide greater anonymity for charitable giving.

- Flexibility: DAFs still offer flexibility in grantmaking (just to a slightly lesser degree) and also allow for the involvement of multiple generations.

For most business owners, especially those seeking to maximize tax benefits while minimizing administrative burdens, a DAF is the more practical and efficient option for donating privately held stock. While a private foundation can be a powerful tool for large-scale philanthropy and legacy building, the increased complexity and costs often outweigh the benefits for many.

Strategic Planning for Charitable Giving

While this article highlights the potential benefits of donating privately held stock, it’s crucial to understand that these transactions require careful planning and execution that can take years to implement. Business owners should consult with their advisory teams, including tax and legal counsel, to ensure compliance with regulations and maximize the benefits of their charitable giving. This proactive approach ensures that your exit strategy aligns with both your personal and business goals, allowing you to create a lasting impact through strategic philanthropy. At Richard P. Slaughter Associates, we help business owners navigate these complex decisions, ensuring their charitable intentions are met in the most efficient and effective manner.