A Starting Point for Managing Volatility

In the upcoming third edition of Worth Magazine, I’ve written an article that examines the best strategies for managing volatility. That piece addresses several angles and makes mention of tools used for managing volatility, including written expectations for upside and downside possibilities.

However, for many people, the first hurdle is knowing where to start just to understand these personal expectations.

For most, that starting point is to establish a global self-assessment to identify the amount of drop or rise an individual can tolerate in their investments. Fortunately, there are several tools available to assist with this task. These tools are great for identifying the emotional and personal risk tolerances for each person involved and recommending boundary points for taking action with investments.

One note: you’ll want to utilize these tools at a time when the markets are relatively stable and before any headlines are made by significant shifts in the markets.

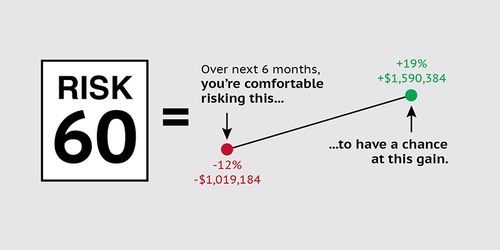

As an example, here is an output from a program we use for clients called Risaklyze.

This result tells us that over the next six months, the investor is comfortable risking a loss of -12% (or -$1,019,184) in exchange for the chance of making a gain of +19% (or +$1,590,384). This range describes the ‘comfort zone’ for investments. For a six-month period, it represents a hypothetical target that the investor would prefer to maintain for investments, though there is no guarantee any investment will perform within the identified range.

By answering a number of risk tolerance questions, the program and advisor can establish these upper and lower boundaries for the client. Once that is accomplished, actual portfolios can be analyzed.

Standard deviations are useful for each investment as they provide the historical expected range of price movements. However, one limitation to this is that it assumes a symmetrical movement either up or down from the mean.

In real life, many investments exhibit asymmetrical behavior. An upside or downside capture ratio helps detect such phenomena, and it’s often noticeable for each individual investment. Unfortunately, it is not a simple weighted average. Due to correlations and diversification, the calculation is more cumbersome for all investments.

Once again, software designed for this task can be a time saver. In the below illustration, a sample portfolio was entered into Riskalyze to produce this resulting example:

In this case, the risk score is very close to the global self-assessment score calculated earlier. Due to variables in rounding, this would be considered an appropriate portfolio. If the actual had scored significantly higher than the desired standard, action would be advisable to lower the number and range through increased cash, fixed income, safer alternatives, or option strategies. Likewise, if the score was markedly lower, the process could be reversed.

One caution to note, this process is used to help people emotionally withstand and analyze volatility. It is not a mathematical process meant to direct investors on how much risk/return they should pursue to meet financial goals. That type of advice should come from working with a financial advisor or wealth manager while developing a comprehensive financial plan specific to your situation and goals.

Once the emotional and mathematical analyses are combined into a plan, the task turns to monitoring. Both portfolios and personal risk tolerances are subject to drift over time. Thus, it is essential to regularly check your positions with your advisor to see what adjustments should be made.